people's pension tax relief at source

B. HMRC call it relief at source.

Child Tax Rebate Who Qualifies For This One Time 250 Payment Marca

The Peoples Pension Trustee Board appoints new Trustee 31st May 2022.

. The plan would provide people in this tier with 250 per tax filer plus an additional 250 if the filer has at least one dependent. Free Case Review Begin Online. Ad Compare the Top Tax Relief Services of 2022.

Ad Based On Circumstances You May Already Qualify For Tax Relief. Salary Sacrifice - this method can be used by any type of pension. 15 2021 and have been a California resident for six months or more of the 2020 tax year as well as on the date.

When you set up your workplace pension with The Peoples Pension you can choose to deduct your employees contributions from their wages either before or after tax. Tax relief on pension contributions may be given in two ways. Ad End Your IRS Tax Problems.

Your pension provider claims tax relief for you at a rate of 20 relief at source Life insurance policies You cannot get tax relief if you use your pension contributions to pay a personal term. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Ad Client Recommended Services.

Ad Based On Circumstances You May Already Qualify For Tax Relief. If a net relief at source pension contribution of 80000 was made using some of the investment proceeds 100000 would be allocated to the pension scheme. A Rated BBB Member.

Tax relief can be. Relief at source means your contributions are taken from your pay after your wages are taxed. Receive Options Quote With No Obligation.

Relief at source means your contributions are taken from your pay after your wages are. BBB Accredited A Rating - Free Consult. Gavin Newsom and legislative leaders announce a tax relief plan that includes refunds of as much as 1050.

Your pension contributions are deducted from your salary before Income Tax is paid on them and your pension scheme automatically claims back tax relief at your highest rate of income tax. Members will get tax relief based on their residency status at the. A personal contribution will receive the.

Net tax basis is great for lower paid employees. It was established in 2000 and is an active member of the. It was established in 2000 and has since become an active member of the.

Ad See the Top 10 Ranked Tax Debt Relief in 2022 Make an Informed Purchase. Compare Us Save. It is part of a 300.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Basic rate tax relief at source -This option should be selected for pension schemes where the pension provider claims tax relief on behalf of the employee and adds it to the employees. Get a Free Qualfication Analysis.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. Then we automatically claim tax relief for you from HMRC adding the basic rate of tax of 20.

Scottish taxpayers who are under a relief at source pension scheme will receive tax relief at the tax rate. Get Instant Recommendations Trusted Reviews. Under this tax basis youd deduct employee contributions from their pay after tax is taken.

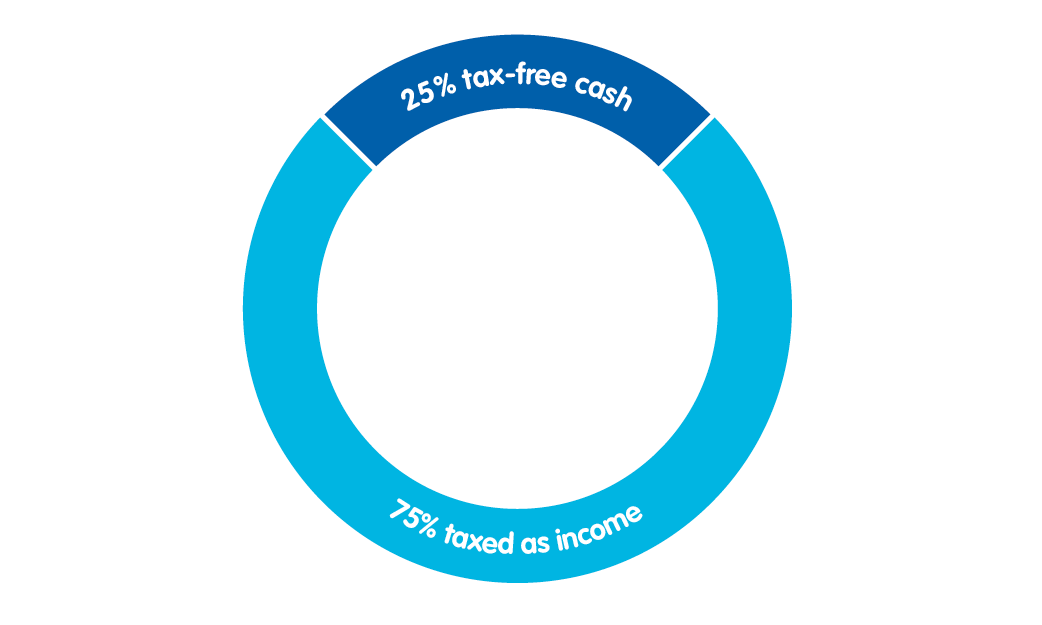

Click Now Find the Best Company for You. Relief at source is a deduction taken from an employees salary after tax is applied. 25 tax relief Higher or additional rate tax The government incentivises people to pay into private pensions by offering a tax break on contributions.

End Your IRS Tax Problems Today. Then The Peoples Pension claims the tax relief at the basic 20 rate of tax from the government. In a net pay scheme contributions are deducted from the employees gross salary ie.

About the Company Tax Relief At Source On Pension Contributions CuraDebt is a debt relief company from Hollywood Florida. Your pension provider applies tax relief by claiming back the basic rate from HMRC to add to your pension. Net pay or relief at source.

This means that basic rate taxpayers and non-taxpayers get tax relief. A 17 billion inflation relief package will offer. Compare the Top Tax Relief and Find the One Thats Best for You.

Relief at source is a way of getting tax relief for the contributions that you made into your pension scheme. Relief at source this is the method used if your plan is a Group Personal Pension Plan or a Group Stakeholder Pension. Your pension provider will do it automatically for you for the tax that you paid at the.

Thats why we call. After weeks of talks Gov. Youll need to update their contribution on Pento to the Net percentage ie.

See If You Qualify For IRS Fresh Start Program. Ad See the Top 10 Tax Relief. 1 day agoTo qualify people must have filed their 2020 tax return by Oct.

See If You Qualify For IRS Fresh Start Program. By law pension providers are able to claim tax relief for this group of workers without an NI number. Theres another type of tax relief arrangement called relief at source.

Get Professional Help Today. Free Case Review Begin Online. About the Company Pension Tax Relief At Source CuraDebt is a debt relief company from Hollywood Florida.

In this kind of scheme the employer must deduct 80 of employees pension contributions from their take-home pay.

Pensions Tax Relief Contributions Explained Interactive Investor

Pension Tax Relief On Pension Contributions Freetrade

Pin By Sue Burns Crill On Money Make Save Unclaimed Money Finding Yourself Helpful

Tax Brackets 2022 Will Tax Brackets Change This Year Marca

Pension Contributions In Ireland Pension Support Line

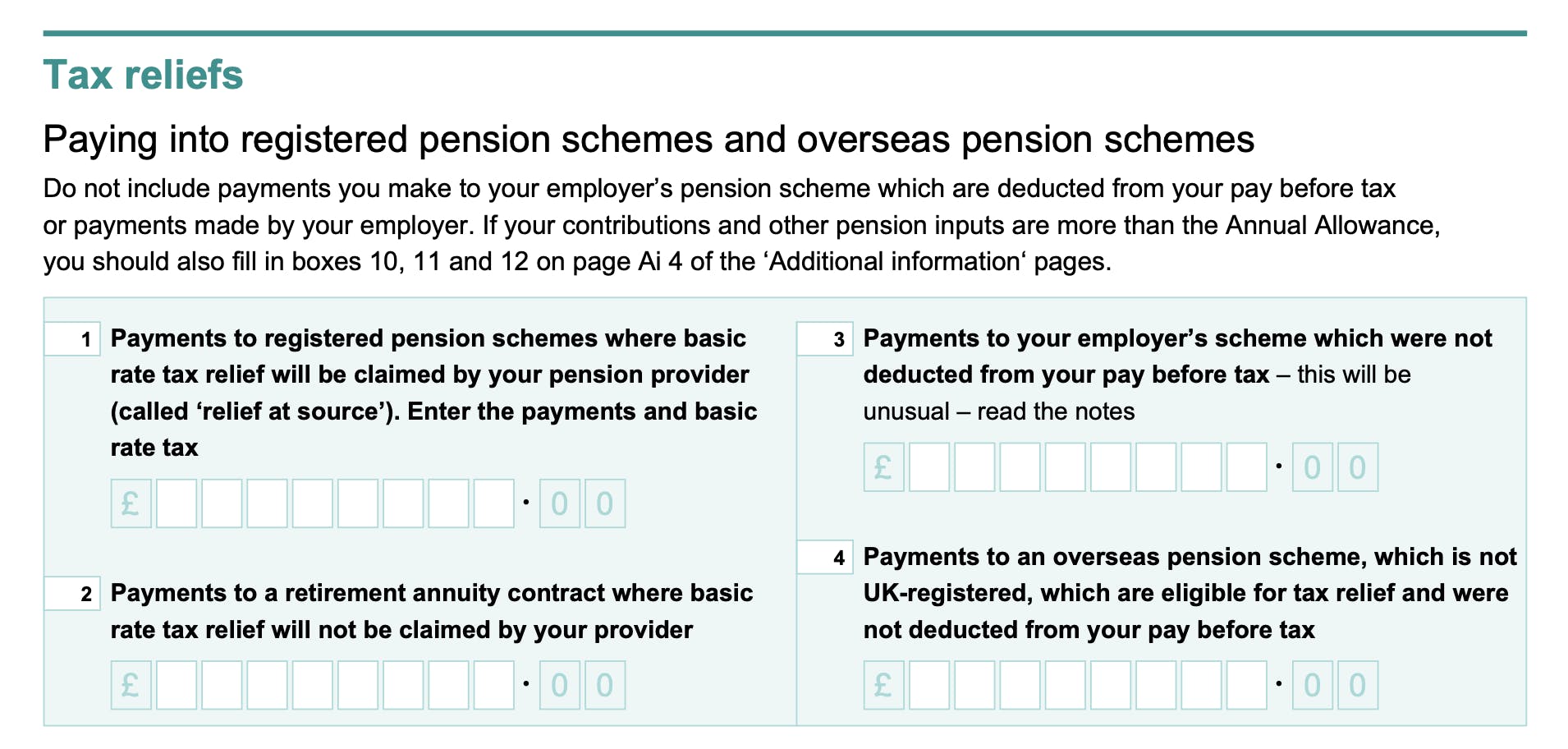

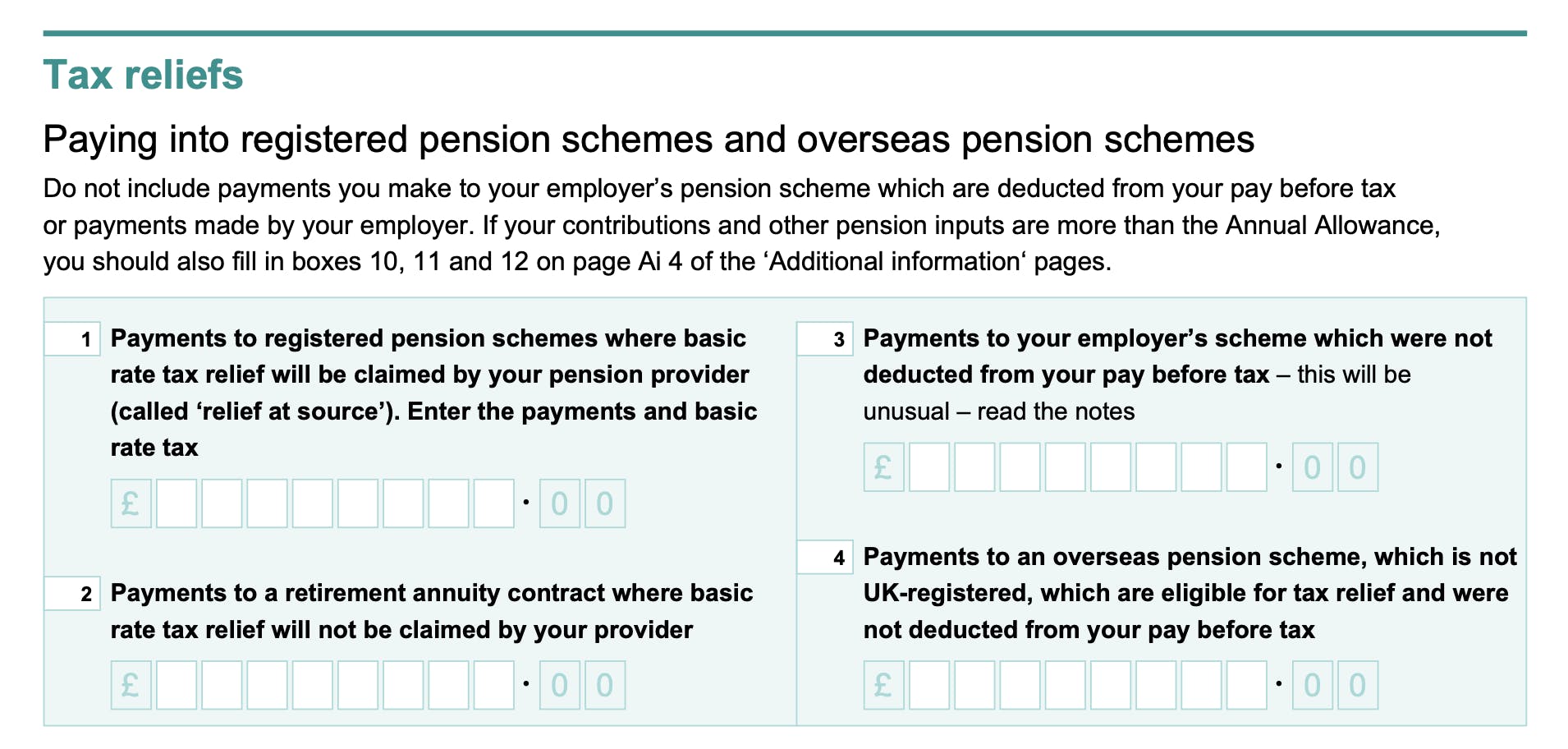

How To Add Pension Contributions To Your Self Assessment Tax Return

Pension Tax Relief On Pension Contributions Freetrade

Workplace Pension Contributions The People S Pension

How Pension Tax Relief Works And How To Claim It Wealthify Com

The Master List Of All Types Of Tax Deductions Infographic Tax Time Tax Debt Relief Tax Deductions

Pension Tax Tax Relief Lifetime Allowance The People S Pension

60 Tax Relief On Pension Contributions Royal London For Advisers

Pension Tax Relief On Pension Contributions Freetrade

Tax Relief On Additional Voluntary Contributions

How To Pay Tax In Spain And What Is The Tax Free Allowance

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Pension Tax Relief On Pension Contributions Freetrade

60 Tax Relief On Pension Contributions Royal London For Advisers